In this age of internet and digital currencies, everyone is trying to be a part of this new game. The concept of blockchain has somehow become the gold rush of 21st-century.

That is why names like Bitcoin, Ethereum, Litecoin, Ripple, Dash, Monero are becoming more and more mainstream day by day.

And believe me, you don’t want to be left out. But what if you don’t know a single thing about cryptocurrencies? No worries. Coinsuggest has got you covered.

Actually, it has been the main goal of coinsuggest from the very beginning. It’s our mission to educate newcomers about cryptocurrencies and create awareness.

The concept of cryptocurrencies itself is quite complex. Let alone trading it like a pro. Yes, I do agree that delving into the world of cryptocurrencies can be a bit daunting at first.

Considering the sheer amount of cryptocurrencies available right now.

Around 1280 cryptocurrencies to be exact, and that too without counting the projects that are in development.

But seriously it becomes easier once you finally set your foot in and start learning. And that’s where this article comes in. This article will cover the basics of cryptocurrency. It will also run you through topics like buying and trading cryptocurrencies.

Although I have written this article mainly for the newcomers, people who already know about cryptocurrencies can benefit from some of the sections.

However, this course, by no means, is going to teach you about each and every critical details of the blockchain technology and cryptocurrencies.

I have compiled some of the best courses to take on this topic. The course list includes six paid as well as two free courses and bonus study materials.

Contents

What Is A Cryptocurrency? How Does It Differ From Fiat Currencies?

Before we start talking about cryptocurrencies, let me ask you one thing.

What is money? I got you thinking hard right there, didn’t I?

Some will say money is something that we pay with, or money is a medium of exchange. Some might also say money has something that has a value associated with it. It is very hard to explain the term “Money” because it’s such a vast term. Money is not only the bills and coins in your wallet, it is also an ecosystem of its own.

Usually, this ecosystem includes a central bank which creates the money or currency and some banks which help in distributing the money amongst the citizens. It also includes people like you and me, without our acceptance money does not have any value.

The only reason money exists and will continue to exist is because we trust in it. We put trust in our government, we put trust in our central banks and commercial banks, we put trust in third-party services to process payments for us and the list goes on.

And that is the main problem with fiat or traditional currencies. In a centralized economic system, the government and corporate bodies hold all the power to print and distribute money. So when a government fails, the economy goes down the drain with all the printed money!

Now suppose there exists some form of currency that is not controlled by any central authority. Instead, the users and common people are the ones who control it.

Imagine an ecosystem where we can create money ourselves, transact it between us without a central node watching over. Well that my friend what cryptocurrency is all about. It is a form of digital currency which is peer to peer and decentralized.

Read –

How Do Cryptocurrencies Work?

In simpler terms, a cryptocurrency is a digital asset. In 1998, Wei Dai proposed a digital currency system which can be viewed as one of the earliest prototypes of cryptocurrency. But Nick Szabo is the one who theorized a cryptocurrency called “bit gold”, considered to be the father of Bitcoin.

A cryptocurrency doesn’t depend on a central body to create the units. It also doesn’t require you to put your trust in the system or a third party organization to complete your transactions.

Instead, it is completely trustless and questions everyone about the authenticity of a record. Unlike a centralized system there are no private ledgers either, instead, there is a public ledger called the blockchain.

One of the critical aspects of cryptocurrencies is mining. Miners are the ones who verify transactions that take place. Transactions get grouped into a block and the system cryptographically secures it. After this, it’s up to the miners to crack the cryptographic puzzle and verify the block.

If the block turns out to be legitimate, then it gets added to the blockchain. The system, in turn, rewards the miner, which completed the process, some kind of rewards. Most of the times the reward is the native currency. So miners are also the ones which create new currencies. This system is called proof of work.

As the miners need to complete a certain task to be able to add the block to the chain.

On the other hand, we have newly created proof of stake algorithm. This algorithm is much more environment-friendly.

As it doesn’t require wasting a whole lot of energy for mining like proof of work. Instead of PoS, we have validators or forgers who have a considerable stake in the cryptocurrency. So they get the privilege to verify the blocks.

How Many Cryptocurrencies Are Available In The Market?

According to Coinmarketcap, there are 1283 cryptocurrencies circulating the market right now. Some of them are very popular, some of the not so, some are undervalued and some are complete scams.

But you cannot ever go wrong with the top few cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple, Dash, Monero etc. All of them are very popular amongst cryptocurrency enthusiasts.

But Bitcoin is still the king of all cryptocurrencies. It is partly because it is the first ever fully functioning cryptocurrency created.

Currently, Bitcoin has a market cap of $123 billion. And each unit is selling for around $10500. Although Bitcoin went through a lot of ups and downs, the numbers always seemed to project high.

What Are Some Of The Most Valuable Cryptocurrencies?

As I mentioned above, Bitcoin still remains the most valuable cryptocurrency ever created. There were many skeptics who didn’t believe cryptocurrencies are a viable solution to our “ancient” economic system. But Bitcoin proved them all wrong and kept on growing.

Actually, the success of Bitcoin was the main reason behind the creation of most of the altcoins.

In my opinion, after Bitcoin, the second popular cryptocurrency is Ethereum and I don’t think many of you will disagree with this. Extremely talented teen programmer Vitalik Buterin came up with the concept of Ethereum.

He believed that Bitcoin lacked its own programming language for creating decentralized applications and smart contracts. But Ethereum could solve this problem.

So he created Ethereum, which brought about a huge change in the cryptocurrency world. Ethereum is currently the world’s largest distributed computer network and has a market cap of $31 billion.

Although the price per coin is much lower than Bitcoin, sitting at $329, Ethereum is still a very popular option. Currently, Ethereum has the most market share in initial coin offering projects.

Apart from Ethereum and Bitcoin some of the other very popular cryptocurrencies are Litecoin, Ripple, Dash, Monero, Neo, Zcash etc also a new hard fork of Bitcoin called Bitcoin cash.

What Are Ethereum Tokens?

Most people I have talked with believe that ether, the native currency of Ethereum and Ethereum tokens are the same thing. But, it’s not! You see, Ethereum is not only a cryptocurrency but also a distributed computer system.

This network of computers or nodes is called Ethereum Virtual Machine.

Now Vitalik solved one of the fundamental problems of Bitcoin, not having the ability to create smart contracts with Ethereum.

Ethereum has its own programming language like solidity, serpent etc to create smart contracts.

Smart contracts can be viewed as a series of events that takes place and gets something done in the Ethereum network. Smart contracts are built upon the original blockchain and have access to the network. Actually, smart contracts are like the raw materials for decentralized applications.

Now a decentralized application is literally a world of its own. So it has its own native currencies called tokens. The token prices are pre-calculated and valued against the native cryptocurrency like Ethereum. These tokens are usually distributed among supporters through initial coin offerings or ICOs.

An ICO is a crowdfunding campaign where a new DApp attracts its initial client base.

For example, some of the very popular decentralized applications are Golem, Bancor etc.

There are two types of tokens – work tokens and usage tokens. Acquiring work tokens is like acquiring stake or shares of a company or organization.

The DAO is a great example of work token. As a side note, the DAO is what caused the hard fork in the Ethereum network which created Ethereum classic. While usage tokens are a bit different.

For example, in Golem’s decentralized network Golem Network Token or GNT is the native currency. And this GNT is a token, a work token to be specific.

How To Buy, Sell And Trade Cryptocurrencies?

Buying Cryptocurrencies

Cryptocurrencies can be bought in a lot of ways. Let’s discuss them below.

Using Fiat Currencies

Some cryptocurrencies allow you to buy them using fiat currencies. For that, you will need to create an account in a cryptocurrency exchange and buy the cryptocurrencies of your choice against fiat currencies.

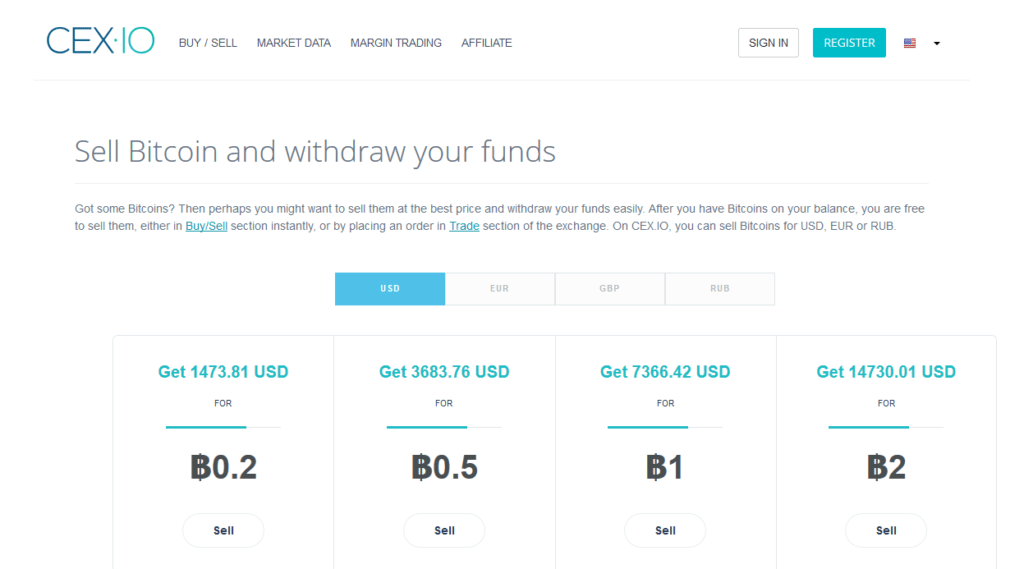

Some exchanges that allow this are – Bitfinex, Cex.io, Coinbase etc.

Exchanging A Cryptocurrency To Another

Another very popular process of acquiring cryptocurrencies are exchanging cryptocurrencies you already have for cryptocurrencies you want.

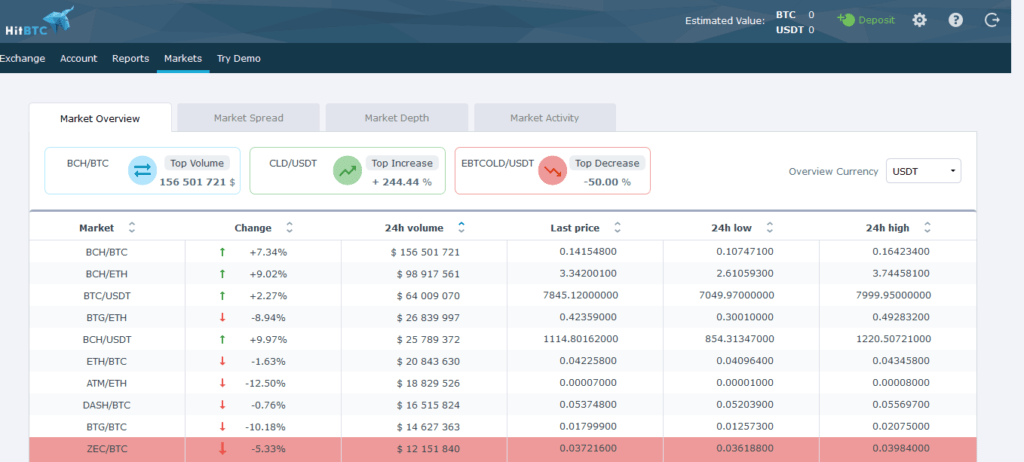

Say you have some BTC and you want to acquire some ETH. You can simply exchange or convert your BTC to ETH. Some of the very popular sites for exchanging are Changelly, HitBTC, Kraken, Shapeshift, GDAX, etc.

Selling Cryptocurrencies

Just like you can buy cryptocurrencies very easily you can sell them very easily too. The process is fairly similar to that of buying.

You just place a sell order and receive the fiat currency of your choice. Most exchanges that allow you to buy cryptocurrencies with fiat currencies also accept selling for fiat currencies.

For example Coinbase, Bitfinex, Cex.io etc.

Trading Cryptocurrencies

Trading is a very advanced matter and only the pros do it. It’s just like trading stocks in an exchange. But instead of stocks, it is a cryptocurrency that you trade.

Some of the very popular cryptocurrency trading sites are Binance, HitBTC etc. These exchanges also allow you to create dynamic sell and buy order for automating the process of trading.

How To Store Cryptocurrencies?

In a centralized economic system, you have banks to store your money. But in a decentralized system like cryptocurrencies, has no banks.

Instead, it has wallet services. Wallets are personal and it’s your duty to maintain your own wallet. Wallets can be both software and hardware.

Software Wallets

Software wallets are either wallet software that can be installed on your computer or online wallets. Online wallets are provided by a third party and are somewhat centralized in a sense.

Some very popular online wallet services are Coinpayments, Bitgo, Blockchain, Greenaddress etc. There are certain security risks with web wallets so users usually avoid these wallets.

But I use Binance an exchange to store my coins.

Desktop wallets are considered more secure than web wallets.

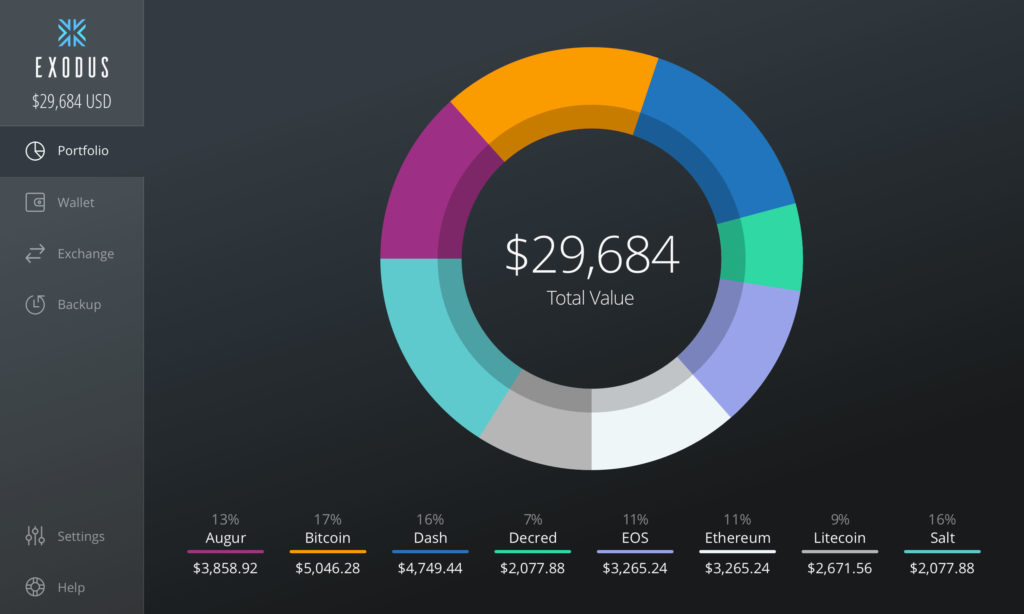

I personally use Exodus as my desktop wallet but there are other choices too.

For example, we have Electrum and also most cryptocurrencies provide some sort of original desktop wallet for their particular cryptocurrencies on their sites too.

Hardware Wallets

Hardware wallets are hands down the best option for people who are seriously into cryptocurrencies and have invested a lot of money.

These wallets are very secure and fast.

Usually, hardware wallets are as big as a simple flash drive.

At first, you need to set up the wallet and write down your keywords for recovery.

After that, you can easily transact by connecting it to a computer and opening the provided software interface.

Hardware wallets are very secure because the transactions do not take place on the computer. Instead, they take place in the hardware wallet itself.

And the wallet sends an acknowledgment to the computer that the transaction has been carried out.

I am a bit biased towards Ledger Nano S, as it provides great functionality and security for cheap. It is very lightweight too.

Some other great options are Trezor, KeepKey etc.

There is a third type of wallet too. It is called paper wallets. Paper wallets are also called cold wallets as these are offline in the truest sense. Paper wallets can be generated from a lot of sites. But I personally recommend using Bitcoinpaperwallet and bitaddress.

Once you generate the paper wallet you can take a print out. Cut out the wallet part as guided and keep it safe somewhere. You will need the keys to performing transactions, so keep it safe.

Some people prefer to laminate the wallet or keep it in a fancy cover so that it doesn’t get tampered.

Conclusion

As a fellow cryptocurrency enthusiast, it gives me great pleasure to introduce people to the world of cryptocurrencies. I had this article planned for ages but never really got the time to write this.

Anyway, here it is. I hope you liked it. Please share to let your friends know about cryptocurrencies and create awareness about our site.