Cryptocurrency is no longer a niche market for tech enthusiasts. As digital assets become more widespread and gain mainstream acceptance, it’s crucial for newcomers to understand the different ways to store and secure their investments. In this article, we’ll dive into the world of cryptocurrency wallets and discuss the primary differences between hot wallets and cold wallets. Our goal is to provide a comprehensive yet easily understandable guide, so you can make an informed decision on the best storage solution for your digital assets.

Contents

Understanding Cryptocurrency Wallets

Before delving into hot and cold wallets, it’s essential to understand what a cryptocurrency wallet is. A cryptocurrency wallet is a secure digital tool that allows users to store, send, and receive digital currencies like Bitcoin, Ethereum, and other altcoins. Wallets do not store the actual coins but rather the private keys required to access and manage the cryptocurrency.

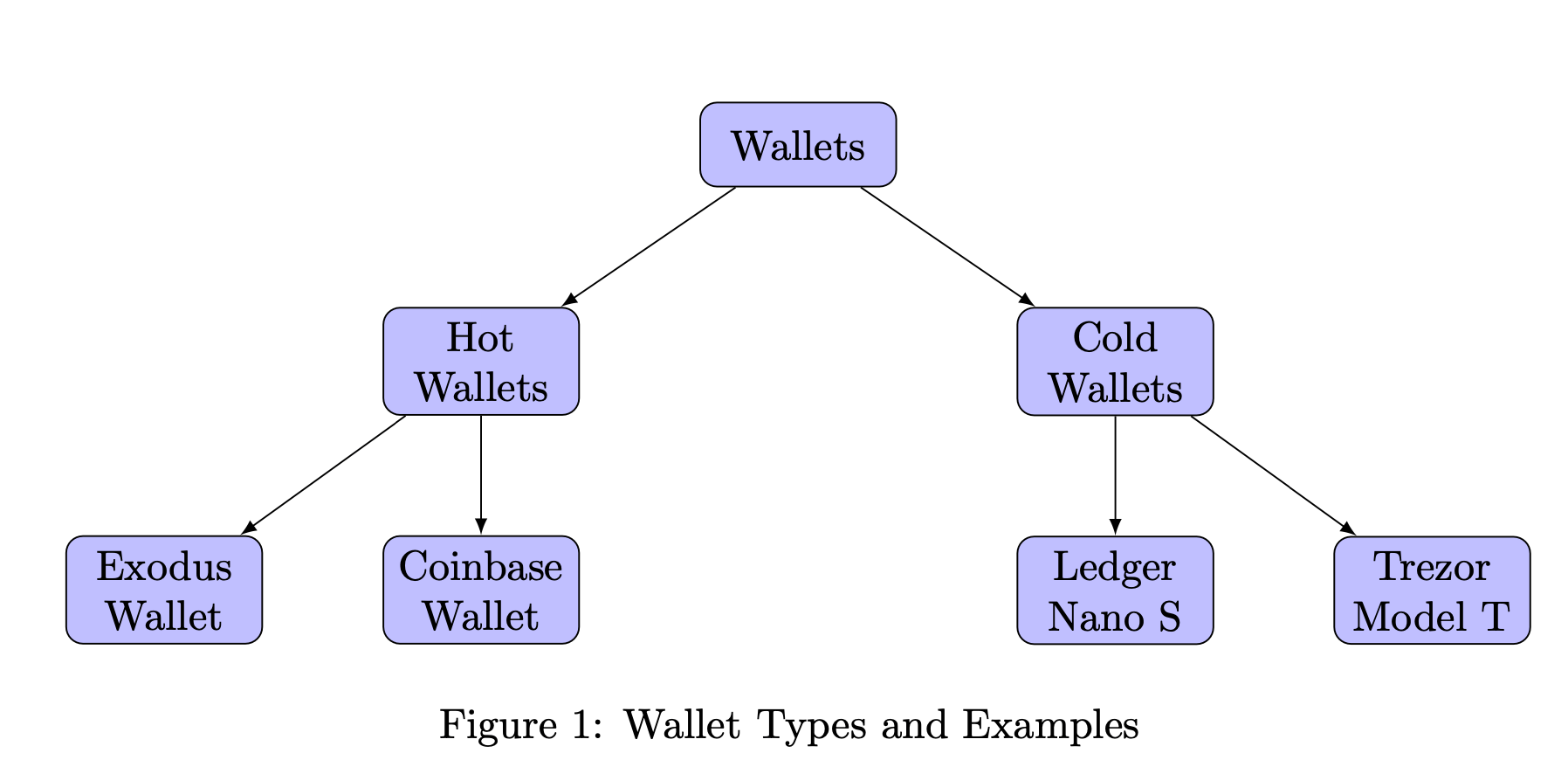

There are two main types of cryptocurrency wallets: hot wallets and cold wallets. Each type has its own set of advantages and disadvantages, depending on your needs and preferences.

Hot Wallets: The Convenient Option

A hot wallet is a digital cryptocurrency wallet that is connected to the internet. This connectivity allows for easier and faster transactions, making it ideal for everyday use. Some of the most popular hot wallets are software wallets, web-based wallets, and mobile wallets.

Advantages of Hot Wallets

- Accessibility: Hot wallets are easily accessible from any device with an internet connection, making them perfect for day-to-day transactions or frequent trading.

- Ease of use: Many hot wallets have user-friendly interfaces, allowing even non-tech-savvy users to navigate and manage their crypto assets with ease.

- Free or low-cost: Most hot wallets are free or have minimal fees, making them an attractive option for users on a budget.

Disadvantages of Hot Wallets

- Security risks: Since hot wallets are connected to the internet, they are more vulnerable to hacking, phishing, and malware attacks. Users must stay vigilant and take necessary security measures to protect their assets.

Cold Wallets: The Secure Choice

Cold wallets, in contrast to hot wallets, are not connected to the internet. They provide a more secure way to store cryptocurrencies, primarily used for long-term investments or large amounts of digital assets. The most common types of cold wallets are hardware wallets and paper wallets.

Read –

Advantages of Cold Wallets

- Enhanced security: By being offline, cold wallets are less susceptible to hacking, phishing, and malware attacks. This makes them a preferred choice for users seeking a more secure storage solution.

- Long-term storage: Cold wallets are ideal for users who wish to store their cryptocurrency investments for an extended period without the need for frequent transactions.

Disadvantages of Cold Wallets

- Inconvenience: Cold wallets are not as user-friendly as hot wallets and may require additional steps to set up and access. This can be a drawback for those who need to make frequent transactions or trade regularly.

- Cost: Hardware wallets, a popular type of cold wallet, can be expensive, ranging from $50 to $200. This may deter some users, especially those with a limited budget.

Examples of Cold Wallets

1. Ledger Nano S: The Ledger Nano S is a popular hardware wallet that provides robust security for storing cryptocurrencies. It supports a wide range of digital assets and connects to your computer via USB. The device’s OLED display and physical buttons allow users to verify and confirm transactions securely.

2. Trezor Model T: The Trezor Model T is another reputable hardware wallet, offering a touchscreen interface and support for various cryptocurrencies. It also features advanced security measures such as a PIN code, passphrase protection, and device recovery options.

3. Paper Wallet: A paper wallet is a simple and cost-effective method for storing cryptocurrencies offline. Users can generate a paper wallet using a dedicated online service, print their private and public keys, and store the physical document in a secure location. While less convenient than hardware wallets, paper wallets provide a high level of security if properly created and stored.

Examples of Hot Wallets

1. Coinbase Wallet: As one of the largest cryptocurrency exchanges, Coinbase offers a user-friendly web-based wallet for managing various digital assets. The wallet is easy to set up, and users can access it from their browser or mobile device.

2. Exodus Wallet: Exodus is a software wallet available for desktop and mobile devices. It features an intuitive interface and supports over 100 cryptocurrencies. Users can also exchange and manage their assets directly within the wallet.

3. Mycelium Wallet: Mycelium is a popular mobile wallet for Android and iOS devices, primarily focused on Bitcoin. It offers advanced security features, including PIN protection and backup options.

Choosing the Right Wallet for Your Needs

| Hot Wallets | Cold Wallets | |

|---|---|---|

| Connectivity | Online | Offline |

| Accessibility | High | Low |

| Ease of use | High | Medium |

| Security | Medium | High |

| Cost | Low | Medium to High |

| Ideal for | Daily transactions | Long-term storage |

When deciding between a hot wallet and a cold wallet, consider your specific needs and preferences. If you require easy access and convenience for daily transactions or frequent trading, a hot wallet may be the better choice. However, if security is your primary concern and you plan on storing large amounts of cryptocurrency for the long term, a cold wallet is likely the more suitable option.

Conclusion

Understanding the differences between hot wallets and cold wallets is crucial for making informed decisions about storing and managing your cryptocurrency investments. By considering factors such as accessibility, convenience, security, and cost, you can choose the right wallet type to suit your needs and preferences.

Hot wallets offer the convenience of easy access and user-friendly interfaces, making them ideal for everyday transactions and frequent trading. However, their internet connectivity can also make them more vulnerable to security threats.

Cold wallets, on the other hand, provide enhanced security due to their offline nature, making them an excellent choice for long-term storage and larger investments. However, they may be less convenient and more expensive than hot wallets.

In the end, the choice between a hot wallet and a cold wallet depends on your individual requirements and priorities. By understanding the pros and cons of each type, you can select the best wallet to safeguard your valuable digital assets and ensure a seamless cryptocurrency experience.

I hope now you have an clear idea about – how are cryptocurrency hot wallets different from cold wallets?