Contents

Introduction To Ripple (XRP)

Let’s start this article by saying that Ripple is not your average cryptocurrency network. Ripple is a distributed open source Internet protocol built upon blockchain technology just like Bitcoin and many other altcoins.

Instead of just being a cryptocurrency platform, Ripple also has the potential to revolutionize payment systems as we know it.

OpenCoin came into being back in 2012 and released the Ripple we know today. But in reality, Ripple existed way before that as two separate systems.

Last updated on 12 February 2018

A payment system called RipplePay and a digital currency. The project finally kicked off when both of the teams came together and founded OpenCoin.

The term Ripple is broader than you think. As per OpenCoin, the company behind Ripple, Ripple is not just a protocol. It is a real-time gross settlement system, currency exchange, and remittance network.

Ripple created this platform to solve issues with our current payment systems.

The three main pillars of the Ripple platform is – the distributed open source Internet protocol, consensus ledger and the token called XRP.

The company claims that the Ripple platform can perform extremely secure and almost instant transactions. Even then the charges for that is negligible, which the company calls “nearly free”.

The Ripple Transaction Protocol or Ripple Protocol has the ability to accept several forms of currency and tokens. It can accept fiat currencies like USD, INR, commodities oil, gold, cryptocurrencies like Bitcoin, Ethereum etc.

Not only these, the Ripple platform supports private tokens like frequent flier miles and mobile minutes too. Isn’t that just impressive!

What Makes Ripple Different Than Bitcoin & Ethereum?

Although Bitcoin is undoubtedly the king of all cryptocurrencies, it lacks behind in many aspects. And Ethereum on the other hand tactfully handled these lacks. What makes Ripple better than these two is the fact that Ripple is even better than Ethereum.

Not only this Ripple is much different than traditional payment system.

Speed of Transaction

The official website of Ripple quite accurately claims that while we are living in the future our payment systems are still living in the past.

We are experimenting with IoT and self-driving cars yet not much can be said for the payment systems. In an interview, the CEO of Ripple Brad Garlinghouse joked that it’s better to carry the cash ourselves than to trust payment services.

Current payment systems are slow and heavily inefficient. And Ripple wants to combat this by introducing the RippleNet. Currently, traditional payment systems can take anywhere between 3 to 5 days to process international payments.

While Bitcoin and Ethereum improved upon this, it can be much better. Right now Bitcoin’s system takes at least an hour to settle payments, while Ethereum is faster and takes about 2 minutes.

In comparison Ripple only takes 4 seconds to do the same task. Can you believe that!

Scalability

Bitcoin is an older technology and it won’t be fair to compare it with fairly new offerings like Ethereum or Ripple. But they are coexisting, so we have the right to draw comparisons.

Frankly speaking, Bitcoin is a failure when it comes to scalability and to do some quick fixes the hard fork took place. But still, Bitcoin can handle only 3-6 transactions per second.

While Ethereum can handle about 15 transactions per second, a number which is expected to go up slightly with the release of their new network and POS system.

But Ripple steals the show by having the ability to handle 1500 transactions per second.

Although it is much lower compared to a throughput of VISA, which can handle almost 50000 transactions per second, Ripple is quite confident that they can scale up to that amount.

Stability

Ripple has been here for 5 years now. And surprisingly enough it has been a good ride for them so far. The RippleNet has closed around 34 million ledgers without any issue since its inception.

Furthermore, as Ripple uses a validator based POS system rather POW the energy consumption is also negligible.

So we can say without any doubts that Ripple is a fairly stable and eco-friendly system. Unlike Bitcoin which consumes the same amount of electricity as 3 US households for processing a single transaction.

An amount that will rise higher as the mining difficulty increases.

Transaction Charges

Traditional payment systems are expensive, to say the least. Think about PayPal, they charge quite a bit to process simple transactions.

With Ripple, you can say bye bye to that. On Ripple the transaction fee is negligible and it is deducted from the transaction and destroyed.

How Does Ripple Do It?

While Bitcoin and many other altcoins are stuck with proof of work algorithm to verify their transactions Ripple employs proof of stake.

You can read more about –

In short, POW is more CPU intensive thus requiring more energy to complete useless works. While POS is a more efficient alternative.

Currently, RippleNet provides mainly three types of service. The xCurrent solution for banks, which enables banks to process international transactions instantly.

The xRapid solution for payment providers, which enables them to source on-demand liquidity. And finally, the xVia solution which enables businesses to take advantage of the RippleNet.

Should You Invest In Ripple In 2018?

This is a question that I hear a lot, both in person and on the internet. And my answer is yes – and it will always be yes if Ripple doesn’t screw up.

Currently, Ripple is the 3rd most popular cryptocurrency in terms of the market cap according to Coinmarketcap. It has a market cap of $41 billion USD, placing it just after Bitcoin and Ethereum.

Back in late December Ripple had a market cap of $81 billion USD, trailing just behind Bitcoin back then. In comparison, fairly popular altcoins like Ethereum, Bitcoin Cash, Cardano have market caps of $84 billion, $21 billion and $9 billion respectively.

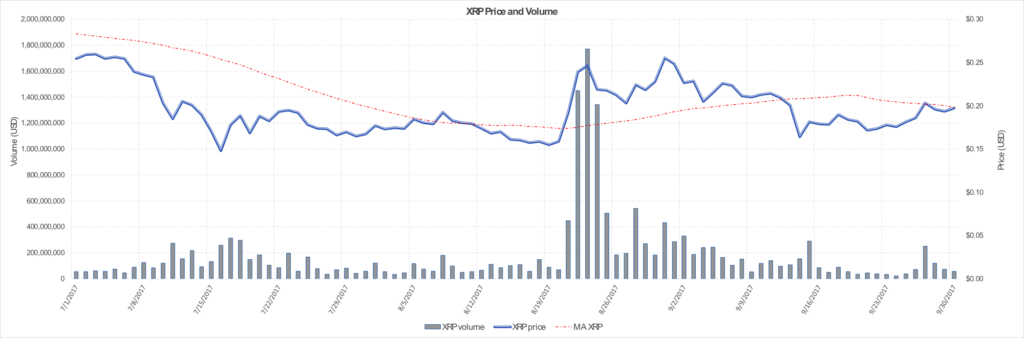

The fall of Ripple’s market cap is closely associated with the fall of entire cryptocurrency market in late January.

Right now, XRP costs about a US dollar per token, down from $2.11 per token in December. Ripple’s low price and potential make it an ideal candidate for newcomers to invest in.

Some people don’t believe in Ripple’s potential because of the low price per token. But they don’t realize that Ripple already has all the XRPs circulating in the market.

There is no concept of mining in Ripple so you cannot compare Bitcoin or Ethereum to Ripple in terms of price.

When Will Ripple XRP Reach $1?

Currently, The RippleNet has over 38 billion XRPs currently circulating. (As of February 2048, the number has grown to 39 billion XRP). So for Ripple to reach a price point of $1 it has to have $38 billion market cap. ($39 billion USD now). Which is possible if certain conditions are met.

Other things that can speed up the price growth of XRP if banks start using Ripple. In day to day lives, banks do a huge amount of transactions. If this does take place then a large amount of Ripple would be destroyed making it lesser in number and increase its price.

According to our Ripple price prediction, XRP might be a slow growth for now. But, when the big players like Banks come in to play we are sure that it will rapidly grow.

UPDATE 1: Looks like our prediction came true. Ripple has crossed the $1 mark with flying colors and currently sits at $2.11

UPDATE 2: Still our predictions hold true. Ripple’s $2 days were shortlived due to a massive fall. But Ripple is still keeping its head up and currently trading for over $1.

But what about its future? Will Ripple be as popular as Bitcoin?

Ah, well I can’t really answer that right now. But judging by its 5-year field record, one can assume that Ripple indeed has a bright future.

In technical terms, Ripple has shown many parabolic movements in this year alone, which is a great sign. The price of Ripple has already surged three times in this year. After seeing the three surges some experts even speculated that Ripple was showing “Elliot Wave” pattern. Which is supposed to be a good thing.

This means Ripple’s prices are about to rise even more.

Final Words

People frequently point out that Ripple has partnered up with big companies like Santander, UniCredit, AMEX and several banks. And they feel this is alarming and should be a concern.

When it should not be. You have to realize Ripple is not just cryptocurrency, XRP is just a part of Ripple.

Ripple’s main goal is to revolutionize the global payment systems. Even Ripple’s official website claims that its main goal is to provide “frictionless experience to send money globally”.

Ripple can potentially become the next PayPal or VISA if it gets the proper support. And the Ripple team surely knows how to get support.

That’s why big companies and banks are rallying behind them. Even big ISPs and MIT have become validators of the RippleNet.

So my advice to investors who have already invested in XRP is to stay put. And my advice to newcomers and skeptics is to try it out before it’s too late.

Check out –